Nordic Nations Provide Clean Energy Leadership

In the past few years, nuclear concerns, rising oil prices, and a growing understanding of our environmental impact has given energy issues a higher profile worldwide. In this report on the Continental Nordic countries, we look at the efforts being made in much of the Nordic region to secure a sustainable energy supply for the future and at the extent to which the innovative solutions of these countries can be exported around the globe.

|

| Vestas V112 3.0-MW turbine. Courtesy: Vestas Wind Systems A/S |

The Nordic region—Norway, Sweden, Denmark, Finland, and Iceland—has always been famous for its darker inclinations. Norse mythology, defined as it is by the ultimate “destruction of the gods,” or “Ragnarök,” inspired Richard Wagner’s brooding Ring Cycle operas and, in more recent times, the tuneless angst of Scandinavia’s own black metal. Then there is the sinister genre of crime fiction that, thanks to Stieg Larsson, has become one of Sweden’s most famous exports. All convey an image of a region whose culture matches its extended gloomy winters.

In an age characterized by growing concerns over energy and environmental issues, however, the Nordic countries are gaining a reputation for something altogether more uplifting than short days and long winters. They are taking an indubitable lead in the international push toward more efficient energy consumption and power generated from more sustainable sources. The 22% of electricity supply that Denmark harnesses from wind power is the highest proportion in the world. Sweden already generates approximately 97% of its electricity from carbon-neutral sources, Norway generates 98.8% of its power from hydro, and Finland generates 29.5% from renewable sources.

In addition to making the most of available resources, the northern climate has arguably played a role in motivating these developments, as long cold winters require significant amounts of energy for heating and lighting.

The most impressive example of Nordic excellence in the energy sector, and arguably the foundation upon which recent innovation has been based, is the Nord Pool network. Created in 1993 as a small spot market for surplus power in Norway, it is now the world’s only multinational exchange for trading electricity, incorporating Norway, Sweden, Denmark, and Finland. In 2010 the Nord Pool Spot traded 307 TWh of electricity on a day-ahead and intraday basis, and this ease of access to the electricity market plays a large role in allowing its participants to invest in new and often intermittent sources of power generation.

Though the Nordic countries have established a strong position in the global energy sector, what is more inspiring is how they are building on these foundations. Finland’s government pushed through its Long-term Climate and Energy Strategy in 2008. Under this policy, the share of renewable energy in the country is set to increase to 38% by 2020. To achieve this target, a feed-in tariff scheme is now supporting power generation from renewable sources such as biomass, waste, and wind. Sweden’s 2009 Energy Policy puts forward objectives such as consuming 50% renewable energy by 2020, a 40% reduction in greenhouse gas emissions by 2020, and no net emissions of greenhouse gases in the atmosphere by 2050. More recently, Denmark has put forward its 2050 Strategy; although details have not yet been clarified, there is broad political support for making Denmark independent of fossil fuels by 2050.

To put the scale of this ambition into context, the European Union (EU) 2020 Plan aims to reduce greenhouse gas emissions by 20% compared to 1990 levels (and by 30% if other developed countries make similar commitments) and increase the share of renewables in energy generation to 20%. Though this is a significant increase from the 6% of renewable energy generation that is the current average among the 27 EU countries (EU 27), it is lower than current levels in all the Nordic countries.

Given the Nordic countries’ experience with renewables, they are now looking at how to export their expertise and success. With the majority of the world’s countries facing the same questions of energy security and the same concerns over their carbon footprint, Nordic models may offer solutions for the international community.

This report looks at just the continental Nordic countries, as they share grid interconnections. Because EU carbon-reduction goals strongly influence national policy, Norway is treated in its own section, as it is not a member of the EU 27.

Wind Power

Although the windmill has existed in central and south Asia for well over a millennium, the modern wind turbine was born in Denmark. (For details of wind turbine technology development, see “Changing Winds: The Evolving Wind Turbine” in our April issue or our archives at https://www.powermag.com.) The 1890s saw the Danish inventor Poul la Cour experimenting with electricity-generating wind turbines, and the modern industry was kick-started by Danish manufacturers such as Vestas, Nordtank, and Bonus Energy.

Today, Vestas is the largest turbine manufacturer in the world, having acquired Nordtank in 2004 and having installed throughout its history 44,000 MW of wind power—roughly a quarter of the world’s total installed capacity. Bonus Energy attracted the attention of Siemens, which acquired it in 2004 to form the core of the Siemens wind power division.

Even foreign companies with no previous ties to Denmark have chosen to establish a presence in the country. “Denmark is where the wind industry grew up,” said Simon Chau, CFO, Europe, of Suzlon, one of the largest wind turbine manufacturers in the world. Despite being headquartered in India, Suzlon has used Denmark as its springboard to the international market. “There is a lot of technology here and a local knowledge base. Today the big three—Vestas, ourselves, and Siemens —all have substantial interests in Denmark because of the availability of expertise and knowledge.”

|

| Simon Chau, CFO Europe of Suzlon |

This intellectual capital dominance persists, despite increasing competition from economies such as China. LM Wind Power, the world’s largest supplier of blades and components to the wind industry, pioneered the use of fiberglass in the construction of rotors, developed the GloBlade concept (increasing annual energy production by up to 5%), and recently announced the world’s largest wind turbine blade: 73.5 meters (241 feet). The latest turbine announced by Vestas has a nominal capacity of 7 MW and a diameter of 164 meters—large enough to fit four A380 Airbuses within its span. Across all of its product range, Vestas can now provide a guarantee of 97% turbine availability, an achievement unrivalled in the industry.

Manufacturers of smaller turbines are also able to carve out a niche due to innovation and technical expertise. Companies like Norwin, a Danish producer of small to midsize wind turbines, are looking to cater to applications where large rotors are unfeasible and large production unnecessary (Norwin’s integration of turbines into the iconic Bahrain World Trade Center building in Bahrain serves as an example).

Outside of Denmark, Sweden’s Vertical Wind and Finland’s Darrox are extolling the virtues of vertical axis wind turbines, one of several options in the focus on gearless wind turbines. Although not enjoying the same reputation in this field as their southern neighbor, Sweden and Finland both have important ambitions in the field of wind power generation. According to figures released by the European Wind Energy Association (EWEA), Sweden’s wind power capacity increased by a hugely significant 38.7% in 2010, a figure representing 308 new turbines with a capacity of 574 MW. Overall, Sweden’s installed wind power capacity jumped up to 2,163 MW. The country plans to achieve total wind power production of 30 TWh—of which 20 TWh is to be onshore and 10 TWh offshore—by 2020. Figures from the Swedish Energy Agency, however, show that in 2009, wind power generation in Sweden was just 2.5 TWh.

In order to attract further investment into the sector and promote growth, a common market for green certificates will be operating in Sweden and Norway beginning in January 2012. “The green certificate common market with Norway is another important step in the right direction. I think that we will achieve its 26.4 TWh generation target by 2016 or 2017,” said Gert-Olof Host, managing director of Triventus, a Swedish company with big plans to capitalize on this quick development.

As Holst pointed out, the company “is gearing up to install between 50 and 70 wind turbines every year from 2013 onwards—up from the 25-ish we put up every year at the moment.”

Wind power generation is also set to experience fast growth in Finland. That country aims to produce 6 TWh from wind power by 2020, corresponding to an installed capacity of around 2,500 MW. According to the EWEA, Finland had 197 MW of installed wind power at the end of 2010. In order to close the gap between reality and ambitions, the Finnish government introduced a feed-in tariff scheme at the beginning of 2011. That program equates to a total subsidy amount of €400 million ($577 million) a year. As soon as the subsidy came into effect, investors rushed to the country. “Finland is already sold out,” stated Markku Tarkiainen, CEO of Intercon Energy, a service company in the wind power market, emphasizing the interest that Finland’s wind power plans are raising among investors and developers. “At the moment, there are development plans for 10,000 MW; just a quarter of them will be realized.”

Local wind turbine manufacturers are gearing up to cope with the expanding demand. WinWinD, a Finnish-Indian group based in Helsinki, plans to launch a new-generation 3-MW wind turbine by the end of 2012. One of the country’s largest start-ups, Mervento, should be rolling out its first wind turbine, a product tailored for the needs of the 4- to 5-MW segment, by the end of the same year. “At the moment, our main focus is on Finland,” commented Guru Vijendran, CEO of WinWinD (Figure 1). “The national targets are ambitious and the feed-in tariff scheme has finally been introduced. I cannot see any reason why we should not get a significant share of the Finnish market. We have been in the market for 10 years, our turbines are already up and running out in the field, and our customers are planning to expand.”

|

| 1. Rotor installation at Ajos Wind Park in Kem, Finland. Courtesy: WinWinD |

Mervento is similarly excited about the potential of the Finnish market. “As a start-up, first we have to establish our presence in the home market,” explained Patrik Holm, the company’s CEO. “I do not think that anyone can be a global player without being strong in his home market. We need to build Mervento’s track record by putting up hundreds of turbines here in Finland.”

Both companies are looking at Finland as a springboard to international markets. WinWinD also hopes to leverage the contacts network of Siva Group, its major Indian shareholder, to grow in the Indian market, and a local production facility has already been established in Chennai. For the time being, Mervento, taking a different approach, does not plan to establish its own production capacity abroad. Its strategy relies on being a “globally local” company, expanding abroad through licensing agreements and joint ventures.

Biomass and Biofuels

Though Denmark may lead the world in the wind sector, Sweden can claim an exalted position in the field of biomass. Exact figures for Sweden’s biomass sector depend upon the metrics used (significantly over 30% of total energy production by the end of 2009, or around 12% of electricity production in 2011), but all available statistics put Sweden near the top of any country rankings in this field. On a continental scale, official data shows that among the EU 27 countries, only Germany, Lithuania, and Austria had a higher proportion of biofuels than Sweden in 2007. This is despite the fact that Sweden already has the highest proportion of renewable energy in the EU: 44.4%. An objective in the 2009 Energy Policy set out to create a “third pillar” in order to lessen the country’s dependence on hydropower and nuclear power. Biomass and wind power are fighting to achieve that status.

Despite this success, it must be admitted that there is a natural limit to the development of a biomass industry in northern Europe. Long cold winters are not suited to growing sugar cane or other primary crops used for first-generation biofuel production and, as the world’s most densely populated continent, available land is limited (even if Sweden has the EU’s second-lowest population density, after Finland).

Companies like Taurus Energy, however, have been inspired by these restrictions to come up with highly impressive technologies that they are now looking to export to larger markets, most notably, the U.S. “The main market for Taurus’ technology is the U.S. The problem is that there is a lot of talk about second-generation biofuels, but the White House is still hesitant to support the industry,” said Lars Welin, CEO of Taurus Energy. “However, sooner or later, the U.S. government must make a move to try to pursue their policy goals. For the time being, in the U.S. there are 200 ethanol production plants; if they want to achieve their 2022 targets, that figure must increase up to 900. And each plant requires a very large investment.”

Taurus Energy has developed a new method, tested on a laboratory scale and in a pilot plant, for producing ethanol from pentoses, the five-carbon sugar molecule. This allows for a far greater range of biomass feedstock to be converted to ethanol, including much of the waste material from agriculture, which currently becomes animal feed.

Dong Energy, Denmark’s largest energy generator (providing over 50% of Denmark’s electricity and over 40% of its district heating), is also interested in this field. Biomass forms an important part of its 85/15 Strategy, in which the company plans to reverse its current portfolio from 85% fossil fuels to 85% renewables by 2040. To that end, Dong Energy is investing heavily in research and development (R&D) activities. Anders Eldrup, CEO of Dong Energy, explains: “Two years ago our main R&D focus was on how to get more value out of biomass, and now we have three very interesting demonstration projects up and running. The biggest demonstration concerns the production of bioethanol from straw. Although we are still in a demo phase, the technology is ready to be marketed, and we have already sold our first plant to a Japanese company. We are also trying to get bioethanol from household waste. Again, the technology is almost ready to go onto the market. Those are just examples of R&D projects that are turning into business. Now we want to do the same with storage issues.”

|

| Anders Eldrup, CEO of Dong Energy |

Farther north, Neste Oil, Finland’s largest oil company, is at the forefront of biofuel technology developments. Its NExBTL, a renewable diesel produced by a patented process, is being successfully tested in road transport and in aviation (Figure 2). The German airline Lufthansa recently flew its first 100% biofuel flight using NExBTL renewable jet fuel. “NExBTL can boast a very good quality: it has a high energy content, it burns very cleanly, and it is very flexible to use,” said Matti Lehmus, Neste Oil’s executive vice president for oil products and renewables. “The percentage of traditional biofuels in fuel blends ranges between 6% and 8%. Our product allows the use of 100% biofuel.”

|

| 2. NExBTL, Neste Oil’s renewable diesel sample. Courtesy: Neste Oil |

The group expects that biofuel demand will grow by 10% a year over the next 10 years on the back of legislation developments all over the world. In Europe, the renewable energy directive binds each member state to increase the energy content of transport fuels from renewable raw materials to 10% by 2020. To take full advantage of these dynamics, Neste Oil has upgraded its biofuel production, investing almost €1.5 billion in two new production facilities in Singapore and Rotterdam. With a capacity of 2,000,000 metric tons, Neste Oil is now the world’s largest producer of renewable diesel.

Ironically enough for an oil company that is heavily investing in biofuels, Neste Oil’s involvement in the sector is under close scrutiny. As with all biofuels, the company is aware that processes in the supply chain can negate the environmental benefits of the fuel’s final use. “We are putting a lot of efforts on ensuring the sustainability of our biofuel production,” said Lehmus. “We want to ensure that the production of the raw materials that we use is sustainable and complies with the EU’s sustainability criteria. On top of that, we are committed to tracking the supply chain all the way down to the field where the raw material is produced.”

Furthermore, the group is spending 80% of its R&D budget on researching new raw materials. “Our strategy is clear,” explained Lehmus. “The technology is there, the production is there, and going forward we will look at expanding the raw material base.”

Finns are also looking in their backyard to find large amounts of biomass suitable for energy purposes. “Seventy percent of the country is covered by forest. Because of that, the whole bioenergy sector is very well developed—from the collecting of the residues from the forest to the making of heat and power out of the wood biomass,” said Santuu Hulkkonen, executive director of Cleantech, an association that represents some of the most interesting Finnish companies dealing with clean technologies.

Finnish pulp and paper manufacturers (two out of three of the world’s biggest paper producers are from Finland) are leading these technology developments. Through biomass-based combined heat and power plants (CHP) they are increasingly using the residues of pulp and paper production to generate energy. The electricity is then used to meet their own requirements in the highly energy-intensive pulp and paper industry or sold into the Nord Pool market or to other industrial players.

UPM, a Finnish pulp, paper, and timber manufacturer that employs 22,000 people in 15 countries around the globe, has built 12 biomass-based CHP plants that produce heat for its factories and electricity for the market. “Over the last 10 years,” said Anja Silvennoinen, UPM’s senior vice president for the energy business area, “we have invested over €1 billion in these biomass-based CHP plants in Europe.”

|

| Anja Silvennoinen, Energy and Pulp Business Group, Senior Vice President, UPM |

UPM is now the second-largest biomass-based electricity generator in Europe. The group is also looking for opportunities in the biofuel production business. “We have been developing the technology for some years,” added Silvennoinen. “Now we have applied for the EU’s NER300 grants for a BTL biorefinery from Finland and France. Both applications have been passed on to the next step, to the European Investment Bank.”

In the long term, UPM aims at “leading the integration of the bio and forestry industries into a new, sustainable and innovation-driven biofore industry.” Other pulp and paper players, such as Stora Enso, the world’s second-largest paper producer, are following this example. Alongside Neste Oil, Stora Enso set up NSE Biofuels, opened a demonstration plant, and is now deciding on the feasibility of a 200,000–metric ton biowax facility.

This deep diffusion of CHP technologies has been driving the development of exportable capabilities. “In the last 20 years,” said Aero Auranne, president for the energy division of the technical consulting company ÅF Group, “most of the schemes implemented in Finland have been based on some form of CHP. All of them have required some special applications—difficult fuels such as biofuels, waste, and so on. These applications require a lot of engineering inputs. Due to this, we have been forced to develop our knowledge in this field and later on, this enabled us to springboard our know-how to neighboring countries, further down to Europe and, increasingly, to South Asia as well.”

ÅF played a major role in the building of several CHP plants in Europe (Figure 3). Apart from its activity in the local market, the company acted as the engineering, procurement, and construction management contractor for projects in Estonia and Germany. Furthermore, it recently announced the closing of a major consultancy contract in Workington, England. The Swedish pulp and paper group, Holmin, will invest 1.1 billion krona ($169 million) in a new CHP plant there, and ÅF has been appointed lead technical consultant for the project.

|

| 3. Gas-fired. This combined-cycle plant in Macedonia is similar to many ÅF Group has built in Europe. Courtesy: ÅF Group |

Energy Efficiency

Politicians like to be able to point to a brand new wind farm to burnish their green credentials. This focus on renewable power generation is reflected in government initiatives, from the EU 2020 Plan down to the national action plans. However, it must not be forgotten that how efficiently a country uses energy is just as important as how it produces it.

“The big challenge” as Rikard Appelgren, managing director of WSP Europe, pointed out, “is that 80% of the buildings that we will have in 50 years have already been built. Compared to the savings in energy efficiency that can be made in these buildings, new energy production from renewable sources is still very small. Especially in Sweden, where we already have a very high proportion of renewable sources in our energy generation, it will be impossible to achieve the government’s ambitions through new energy production alone. WSP is trying to show our clients the cost benefit of improving our use of energy.”

The Nordic countries have an admirable record in this field. The “Danish Model,” whereby Denmark’s economy has grown by 78% while energy consumption has remained stable and carbon dioxide emissions have dropped, is garnering enviable attention from the international community. A Green Growth Alliance signed between South Korea and Denmark during the visit of President Lee Myung-bak earlier this year is an example of this interest, allowing a sharing of capabilities and trade between the two countries.

Jørgen Claussen, chairman of Danfoss and chairman of the Danish Energy Industries’ Federation, explained the primary reasons for the success of the Danish Model as follows: “Firstly, we converted our coal-fired plants into combined heat and power plants. Secondly, we have strict regulation about insulation, thermostats, and the construction of new buildings, leading to lower energy consumption per capita. Finally, over the last 25 years Denmark has allocated a lot of funding to research and development, especially in the field of wind turbines.”

|

| Jørgen Claussen, Chairman of Danfoss and Chairman of the Danish Energy Industries’ Federation |

The first of these reasons should be of particular interest to the international community. Converting a typical coal plant (at least one that is sited near a large commercial, industrial, or residential customer base that can use the heat) into a combined heat and power plant can drastically increase its efficiency. The record for a coal-fired power plant is currently held by BWE, whose ultrasupercritical boilers can reach 47% efficiency, compared to the European average of 38% (Figure 4). Utilize the waste heat from this to feed into a district heating system and the efficiency can shoot past 85%.

|

| 4. Record-setter. The coal-fired 415-MWe ultrasupercritical boiler of Denmark’s Nordjylland Power Station Unit 3 was designed and built by BWE. The plant produces both heat and power. It holds a 1998 world record for efficient coal utilization—up to 91% of the energy content of the coal is utilized. Courtesy: Vattenfall |

“Denmark cannot afford to lose this ultrasupercritical coal technology simply because the country’s policies are changing direction,” stated Michele Passini, CEO of BWE, a Danish company now operating under STF. “There are other countries where coal is the sole viable option. We need to have a clean coal there, and Danish companies like BWE can contribute to clean and low-cost production of energy from coal. These countries have a huge need of additional new capacity. We are talking of tens of thousands of megawatts. Apart from nuclear power, I believe that coal is the sole option left for safe growth.”

|

| Leif Breitholz, CEO, FVB |

Though coal may not fit with the current obsession for clean energy, more efficient use of it can still achieve a huge reduction in carbon dioxide emissions. A district heating expert, formerly working for the energy consultants FVB, calculated that if the EU were to convert all waste heat into district heating, the EU 2020 targets could be achieved through this action alone. Moreover, the simple reality that fossil fuels will not disappear as an energy source in the foreseeable future means that energy markets should be exploring how to integrate them into more sustainable systems rather than replace them.

The Nordic countries have already made good progress in this. In Finland “one-third of the local electricity supply is produced by CHP power plants,” according to Arto Lepistö, head of the energy market unit for Finland’s Ministry of Energy.

Nordic companies have made good use of this head start. BWE, for example, is now one of the market leaders in the rehabilitation of existing boilers to increase their efficiency and their ability to utilize not only coal, but also biomass and gas. GE, with its strong presence in the Nordic region, recently launched a new gas turbine called FlexEfficiency: a 500-MW turbine made to work in combination with wind power and solar power with an electrical efficiency of over 61% (see “Pushing the 60% Efficiency Gas Turbine Barrier” in our July 2011 issue or online at https://www.powermag.com). “Historically, the Nordic region has been an early adaptor of new technologies, and hence it is an exciting region to serve,” said Eystein Aspesletten, GE’s country executive, Nordic region.

The ideal model toward which these technologies seem to be working is a more comprehensive network controlling multiple types and sources of energy. Leif Breitholtz, president of FVB Sverige explained: “Systems are becoming more integrated. In Stockholm, for example, you have heat pumps, cooling machines and deepwater cooling integrated into the same system. Each country will face unique challenges in how to handle renewable and often intermittent energy sources, such as wind power, and this may well require combined district heating and power grids, using excess power to produce thermal energy, and using that thermal energy as a storage solution. All of these possibilities will create challenges and opportunities, not just for FVB, but for the industry as a whole.”

These integrated systems are particularly important in countries where energy consumption is high. Although Denmark is a successful case, its neighbors Norway, Finland, and Sweden are at the top of international rankings measuring energy consumption per capita. Climate and industrial reasons play a role in this. Long, cold, dark winters require buildings to be lighted and heated much more than in most other countries around the world. The pulp and paper industry, whose profile is typically very energy-intensive, represents the bulk of industrial production both in Sweden and in Finland. In both countries, energy consumption related to this sector accounts for around 50% of total industrial consumption.

To address the problem, since the early 1990s, Finland’s Ministry of Employment and the Economy has promoted voluntary agreements for industries and the municipal and oil sectors to enhance the country’s energy efficiency profile. Official figures show that the agreements led to a 9-TWh saving in 2009. The framework has been recently renewed, and its new target has been set at 9% energy saving by 2016 on a 2001–2005 average.

If Swedish and Finnish industries must take partial responsibility for their countries’ high energy consumption, the same holds true for residential consumers. “Normal people have tended to be wasteful,” comments Per Rosenquist, managing director of Statkraft Sverige, the Swedish division of Statkraft, Europe’s largest renewable energy company. “Except for Denmark, Scandinavia has been an area where energy has been either cheap or more cost-effective in its production than elsewhere, and therefore we have not always been efficient when we consume it. If power had been more expensive, you would have seen different patterns of its consumption. Furthermore, people in Nordic countries typically pay a flat daily rate for energy, unlike other parts of Europe. In the last 10 years, as prices have moved up, there has been a dramatic increase in energy-saving investments, but we are still behind some other countries—Denmark moved much faster than Sweden. Twenty-five million people in Scandinavia are consuming roughly the same amount as 90 million Germans, and this is not just due to climate: We have a base industry that is very energy intensive, and is becoming very anxious as our competitive advantage in energy prices diminishes.”

Local companies are developing technologies to make residential energy consumption more efficient. In Finland, Nokia started developing smart living technologies in 2006. Part of that research program was later spun off, giving birth to There Corporation. The company has just rolled out an energy management system tailored for the needs of Finnish summer cottages. It can lead to savings raging between 15% and 30%. In countries where affording power is generally not a problem, smart living applications must ensure energy savings without any loss in comfort. “It is important to get the hard figures, to get the savings,” said Kaj Rönnlund, CEO of There Corporation. “But it is also important, if not more important, to take care of the comfort side of the issue; to give customers the feeling that the house is safe in the hands of our energy management system.”

Others are pushing forward a holistic approach to achieving energy savings in residential buildings. Rehact, for example, is a Swedish company that works with a new type of heat exchanger to make heating and cooling systems more integrated and efficient. “The business model for generating energy is easier than an energy efficiency business model,” said Svante Bengtsson, CEO of Rehact. “Green generation is a more concrete concept, while saving energy is a more abstract one. We are trying to solve this equation; we have the highest quality of life and the highest energy efficiency.”

Smart Grid

The integrated systems mentioned above are an increasingly realistic proposition. “Smart grids” are being lauded as a way not only to improve energy efficiency, but also increasingly as the only way to cope with a more diverse and unpredictable range of new energy sources. “Europe is adding new grid capacity and upgrading the existing one,” explained Bo Normark, CEO of PowerCircle, an association that supports the electric and power technology industry. “Overall, the European continent has 700 GW of installed capacity, and the target is to add other 300 GW by 2020. Most of the new capacity will come from renewable sources, and that will require massive investments in the grid that will generate many opportunities for grid developers.”

A host of companies are, with typical Scandinavian innovation, paving the way for the smart grid futuristic concept to become a reality. GoalArt, a Swedish company established in 2001, has developed algorithm-based software that is able to track energy flows within a grid system and pinpoint faults. Being infinitely scalable, this software is uniquely suited to both the increased complexity of a smart grid and the more extensive integrated European network that many in the Nordic region hope the Nord Pool network will turn into.

PowerSense, a Danish company that split from Dong Energy in 2007, has developed a flow measurement technology based on Faraday effects. This enables its technology to be simply installed onto an existing grid system, where it provides detailed information about the grid and allows faults to be detected. This type of measurement and monitoring technology will become increasingly important in the coming years, as Brian Sørensen of PowerSense explained: “With the EU 2020 strategy, the need for a smarter grid bearing more renewable energy sources and electric vehicles has increased. The business will really boom, however, when politicians realize that, despite all the money they are investing in wind power and solar power, only 30% to 50% of the energy makes it to the consumer; the rest is lost because the grid is not able to collect that new generation.”

|

| Brian Sørensen, CEO of PowerSense |

Electric Transportation

Across the Nordic countries, the commitment to introducing electric vehicles is proving to be an important impetus for smart grid developments, because the grid must be able the bear the additional load of electric vehicle charging spots. In order to do that, it must be strengthened and made more efficient. However, this is not just a question of upgrading the existing grid but also of making it smarter.

“Some estimates show that the usage of electricity in Denmark will increase by 5% in five years’ time,” said Johnny Hansen, CEO of Better Place Denmark, a U.S.-based group committed to developing infrastructure and solutions for electric vehicles (Figure 5). “The problem is that if we do not set up a system that allows people to charge their electric vehicles intelligently, everybody will do that at 5 p.m., when they come back home from work. Therefore, even though the average increase in the usage is just 6%, in order to meet that, utilities must double their investments. Unless we do that in a smart way. Our intelligent charging concept is that we take the electricity for the cars out of the grid whenever there is extra capacity in the grid and we return it whenever there is a shortage.”

|

| 5. A prototype of Better Place’s battery switch station. Courtesy: Better Place |

When it comes to intelligent charging solutions, the challenge goes beyond the technicalities of the issue. “It’s not a big technical problem,” commented Kari Sinivuori, country president for Alstom Finland, “it is a commercial problem—to give the owner of the mobile storage the right value for what they are providing.”

Nokia Siemens Network, the global group that emerged from the merger of Nokia’s and Siemens’ infrastructure businesses, is working on this issue. Thanks to the requirements of the smart grid concept, power distribution and telecommunication technologies are converging, and the group is now trying to leverage its knowledge in the telecommunication sector to address challenges pertaining to the introduction of electric vehicles. “We are building ICT [information and communications technology] solutions where we can handle the payments, the identification, and do the adoption for the different technologies where the charging spots actually are,” said Sami Sailo, Nokia Siemens Networks’ head of strategy and business development for smart grid solutions.

The latter is a challenging task. When electric car users move to different areas, they will encounter different providers of charging spots. “For example,” continued Sailo, “in Finland we have 100 different electricity operators, and that makes it quite challenging to build homogeneous payments systems for electric cars.”

Certainly, despite recent developments, there are still opportunities for innovations. “The feasibility of smart grids constitutes a dilemma,” commented David William Nicholl, country manager for Schneider Electric Sweden. “Current grids were designed as a waterfall: The energy trickles downward from the top. But now we have to factor renewables coming in. Renewable power is not consistent. Its flow is intermittent, and this poses a problem. On top of this, people are beginning to generate their own energy at home. What’s more, electric cars are being rolled out in several countries. Electric vehicles are just big mobile batteries, thousands of mobile batteries moving all around, which need to be plugged into the grid. Looking at the picture as a whole, we see a grid that is already there, but which must be upgraded to work with a new generation balance that is not constant the way it used to be. The intermittency makes it more difficult to put in place the automation systems required. It is a big dilemma, and we don’t have all the right answers to this yet. I would say that no one has the answer yet. But certainly we do have a number of energy management solutions that address these issues.”

While players interested in the smart grid concept continue to develop and test new technologies, carmakers are wondering whether or not they should be rolling out their first electric models. It is a chicken and egg situation: Will the infrastructure enable the commercialization of electric vehicles, or will the presence of electric vehicles hasten the development of the infrastructure?

“We have a very pragmatic attitude toward the infrastructure issue,” said Paul Gustavson, Volvo’s senior vice president for office and business development. “We think that we have to launch the electric model as soon as possible. If there is an infrastructure, we will sell the car. Otherwise, we will not sell the car. The development of the infrastructure is very complex and will be slow. Right now we have slow-charging spots that allow people to charge their electric cars overnight. The problem is that to have a faster charging system we would need to rewire the whole country. Therefore, the assumption in our business case is simple: Our electric model will not need additional infrastructure and charging spots.”

Gustavson confirms that Volvo will deliver its first plug-in hybrid V60, relying on diesel to power the car in situations where the infrastructure is not available, by November 2012.

Norway: The Non-EU Nordic Nation

According to a June 2010 report by NordREG, an organization of Nordic regulatory authorities, total Norwegian electricity consumption was 124 TWh in 2009, a decrease of 2.8% compared to 2008. Whereas EU carbon-reduction goals are a major driver of power policy in the other Nordic countries, Norway—which is not a member of the EU 27—has a different set of concerns. Though it is one of the largest carbon emitters (and plans to be carbon neutral by 2030), power production is not a significant factor in those emissions, as nearly all of Norway’s electricity is generated by hydropower. Most of the year, Norway is a net power exporter.

Norway is also a major natural gas exporter and supplied 20% of EU 27 demand in 2009, second only to Russia’s 23%, according to Eurogas. Norway uses little natural gas domestically—only 4.3% of production in 2009. Statoil (67% owned by the Norwegian Ministry of Petroleum and Energy) is responsible for 80% of Norway’s oil and gas production, primarily from the Norweigian continental shelf, an oil- and gas-rich region four times the area of the Norwegian mainland (Figure 6).

|

| 6. Troll field. Troll is primarly a natural gas field located on the Norweigian continental shelf in the North Sea. This field represents about 60% of Norway’s natural gas reserves, as well as a significant quantity of oil. Three platforms are now working the Troll field. Troll A, shown here, began production in 1996. This platform, at 656,000 tons and 1,549 feet high, is said to be the largest structure ever to be moved by man. Courtesy: Øyvind Hagen/Statoil |

Norway was one of the first European countries to deregulate its electricity market, and in January 1991 it was fully opened for competition. There are now nearly 100 retail suppliers in Norway, where price competition is the fiercest in the region, according to the NordREG report. The market is regulated by the Norwegian Water Resources and Energy Directorate (NVE), which reports to the Ministry of Petroleum and Energy.

Though Norway is the second-largest natural gas exporter to western Europe, gas is an insignificant fuel for power generation within the country. According to NVE, hydro generation accounted for around 99% (140.3 TWh) of total Norwegian net generation in 2008. Generation capacity in 2009, according to NordREG, was 29,626 MW hydro, 431 MW wind (which increased to 441 by the end of 2010, says EWEA), and 899 MW non-CHP thermal.

Newer Renewables. The Global Energy Network Institute has observed that, “as Norway’s energy demand increases, there is limited capacity for further hydropower development.” Consequently, other renewable options and energy efficiency efforts have been receiving recent attention. To that end, Enova SF was created in June 2001 as a public enterprise owned by the Norwegian Ministry of Petroleum and Energy. Its main mission is “to contribute to environmentally sound and rational use and production of energy, relying on financial instruments and incentives to stimulate market actors and mechanisms to achieve national energy policy goals.”

Enova has provided financial support to a variety of efficiency and renewables projects. Among them, in July 2009, it allocated 1.1 billion Norwegian krone (NOK/US$0.2 billion) to support development of four new wind power projects in four counties. Combined, they are expected to generate 456 GWh.

In July this year, following talks with the EU Commission, the European Free Trade Association countries submitted a draft European Economic Area resolution on the renewable energy directive to the EU. The draft establishes a target for Norway’s renewable energy (not just power generation) share of 67.5% by 2020. This represents an increase of around 9.5 percentage points from 2005, according to the Ministry of Petroleum and Energy. If that target is met, renewable energy will account for more than two-thirds of Norway’s energy consumption in 2020—a far higher proportion than in any EU country.

Minister of Petroleum and Energy Ola Borten Moe said in a ministry release, “I am pleased that the efforts to implement the renewable energy directive have taken a large step forward. This is important, not least in relation to the establishment of the common Norwegian-Swedish electricity certificate market in 2012. I would also like to emphasise that the government shares the EU’s ambitions regarding a strong focus on renewable energy. Norway’s target of 67.5 percent reflects our ambitious policy in this area.”

As in the rest of the Nordic region, wind power is playing a bigger role. Norway may be a late entrant to the wind market, but its goal was to make a big splash. In June 2009, the StatoilHydro-owned 2.3-MW Hywind facility, the world’s first large-scale floating wind turbine (manufactured by Siemens), was towed to a North Sea location near Karmøy Island (Figure 7). (See our December 2009 issue for a story on this project, recognized as a Top Plant.) StatoilHydro invested NOK 341 million in the project, and Enova provided approximately NOK 59 million.

|

| 7. Wind on water. The Hywind Floating Wind Turbine was the first large-scale wind turbine supported by an underwater floating structure similar to ones used by off-shore oil rigs. Courtesy: StatoilHydro |

In March of this year, Norwegian-owned Sway deployed the floating turbine Sway I off the country’s coast. The prototype is to undergo up to two years of testing before the company deploys its 5-MW floating wind turbine off the coast of Karmøy, Norway. In an interview last summer, Sway CEO Eystein Borgen noted that land and near-shore water for wind installations in Scandinavia is becoming hard to come by, making deep-water, floating (rather than seabed-mounted) turbines with a ballast more attractive.

Blaaster Wind Technologies AS is another home-grown wind turbine developer. Its first 3-MW direct-drive prototype (partially funded by Enova) will be installed in the first quarter of 2012 at the Valsneset test center in Norway, but it has its eye on a 6-MW model for onshore and offshore installation.

Despite the new enthusiasm for wind projects in Norway, in mid-August, Reuters reported that Denmark’s DONG Energy sold its half of Norwegian wind power producer Nordkraft Vind to co-owner Nordkraft Produksjon for NOK 145 million. The company explained that “The size of DONG Energy’s portfolio of wind projects in Norway is found no longer to warrant a continued strategic focus on expansion of the Norwegian market.”

Oddly enough, for a country with so few sunlit hours a year, Norway is making a name for itself in the solar industry and has established production facilities for its solar technology around the world. Renewable Energy Corp. (REC), for example, has 3,900 employees globally and is among the world’s largest producers of polysilicon and wafers for solar applications and is a growing manufacturer of solar cells and modules. Though headquartered in Oslo, its production facilities include U.S. silicon materials plants in Moses Lake, Wash., and Butte, Mont.; wafer production sites in Glomfjord and Herøya, in Norway and Tuas, Singapore; solar cell production in Narvik, Norway and Singapore; and solar module production in Singapore.

The country is also active in solar R&D. The Norwegian company EnSol AS, for example, has patented a prototype thin film photovaltic cell design based on nanotechnology that can be sprayed onto anything from buildings to airplanes to turn virtually anything into a power generator. The project’s objective is to achieve efficiency of 20% or greater. Commercialization isn’t expected before 2016.

Norway is also among the countries exploring osmotic power. One of the world’s first osmotic power plants started operation at Tofte on the Oslo fjord in Norway in November 2009, producing 2 kW to 4 kW after more than a decade of collaborative research and development by the Norwegian University of Science and Technology and Norwegian state-owned utility Statkraft.

Building a Smarter and More Robust Grid. As NordREG notes, “The Nordic region operates almost entirely as one synchronous power system through [its] transmission grid. The combined system has enabled an increased security of supply as well as a more efficient use of the generation capacity—during wet years hydropower flows southwards and eastwards whereas during dry years thermal power flows northwards and westwards.”

Norway’s reach is about to extend even farther. Norwegian Statnett and British National Grid are planning a 1,400-MW under-sea cable between Norway and the UK. At 800 kilometers (km/497 miles), it will be significantly longer than the current record holder, the 580-km cable between Norway and the Netherlands, which was commissioned in 2008.

At home, the country plans to have smart meters installed for 2.6 million electricity customers by the end of 2016. NVE recently mandated that all 130 Norwegian utilities deploy smart metering systems with highly specific features and attributes, such as daily data collection of 15-minute interval readings, integration of gas and water meters, remote connect/disconnect, secure/encrypted communication, measurement of microgrid generation, and interfaces for reliable communication with in-home displays.

To that end, in July, Fortum Norway awarded a smart grid project to Echelon partner Telvent to deploy Echelon’s smart metering system to Fortum Norway’s 100,000 electricity customers. Fortum, with 1.6 million customers, is a leading energy company in the Nordic countries, Russia, and the Baltic region. Fortum Norway is the seventh-largest utility in Norway and holds a minority interest in Hafslund, the largest utility in the nation.

Controlling Carbon Emissions. Even though Norway’s power sector contributes little to greenhouse gas emissions, its massive oil and gas extraction industry has been developing carbon capture and sequestration (CCS) techniques for some time. As the rest of the world searches for ways to mitigate the effects of power plant carbon emissions, Norway may well play a leading R&D role and has been a pioneer in such work.

In 1991, its government became the first in the world to impose a federal tax on atmospheric carbon dioxide (CO2) emissions from combustion-based point sources. It then allocated a substantial portion of these funds for CCS research programs. At the same time, it developed a supportive legal framework, for example, by resolving liability issues for sequestered CO2.

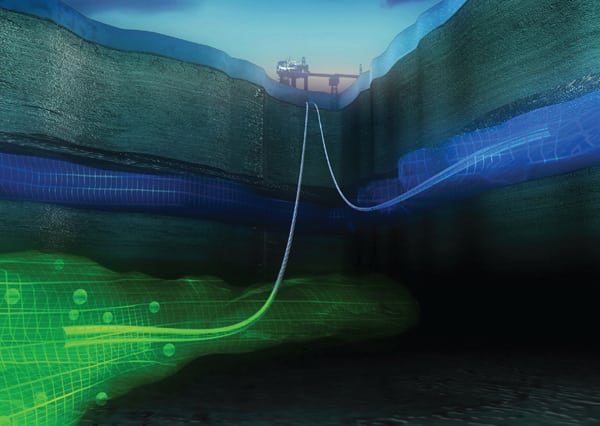

For 15 years, Norway’s StatoilHydro and partners ExxonMobil and Total have been capturing CO2 from the Sleipner gas field, storing it 1,000 meters beneath the Utsira formation in the North Sea, and monitoring their efforts (Figure 8). More recently, efforts have shifted to capturing CO2 from power plants.

|

| 8. Rendering of carbon storage in the Sleipner gas field. Courtesy: Alligator film/BUG/Statoil |

In October 2006, the Norwegian government granted Statoil permission to build a CHP plant at Mongstad. The government and Statoil agreed on developing CCS technology at the roughly $1 billion project in two stages: First, a CO2 Capture Technology Centre (TCM), followed by construction of a large-scale plant. The large-scale CCS project at Mongstad includes CO2 capture (from the CHP plant’s flue gas) followed by transport by pipeline for storage under the seabed in the North Sea. At full capacity, emissions from the CHP plant may be up to 1.3 million tons of CO2 annually.

Construction of the TCM is progressing according to plan, and it is expected to be in operation by 2011/2012, according to the government. TCM is the largest planned pilot project of its kind, with an annual capacity for handling up to 100,000 tons of CO2. The TCM will test CO2 capture on two types of flue gases using two capture technologies; hence, the testing is also relevant to CCS on coal-fired power plants. One source of flue gas is the existing catalytic cracker facility at the Mongstad Refinery, and the other source is the gas-fired CHP plant. Two capture technologies will be tested in parallel: amine technology and chilled ammonia technology.

As with CCS projects elsewhere, there have been difficulties and delays. In October 2010, the Ministry of Petroleum and Energy called for an evaluation of “alternative solutions” to execute a large-scale carbon capture plant after “theoretical studies” indicated health and environmental risks related to amine technology. Testing was planned to start in early 2012. The final investment decision has now been delayed until 2014.

In June, the ministry announced nominations for “suitable areas in the North Sea and the Norwegian Sea for exploration for potential reservoirs for permanent storage of CO2 from Mongstad.” As Minister Moe explained, “The transport and storage of CO2 from Mongstad will be one of the first projects of its kind where CO2 from a full-scale carbon capture plant is transported for storage on the continental shelf.”

The government also had plans for full-scale CO2 capture from Naturkraft’s gas-fired power plant at Kårstø, followed by transportation and storage solutions. (See our September 2008 Top Plant story on this plant.) Though significant preparatory work has been completed on all aspects of constructing the full-scale CCS facility, the plant operated irregularly, which would have limited the environmental benefit of a CO2 capture facility. Consequently, in spring 2010, the government halted the procurement process for this project.

A Green Future?

Renewable energy generation has attracted significant subsidies throughout the world in the past few years. Investors, developers, suppliers, and sub-suppliers have all benefited from this and have built their business models around them. Nonetheless, they are now facing challenging times. The financial and economic woes of Europe and the U.S. have cast a worrying shadow over the future of government incentives that have, so far, constituted one of the primary drivers of growth in the sector.

In the Nordic region, export-oriented companies have faced the additional burden of tightening budgets from the governments of some of their main markets. Vacon, a Finnish producer of AC drives, started selling inverters to the wind power industry in 2004. In 2009, it entered the solar power market. Although growth in these fields has been significant, and 18% of the company’s €338 million revenue comes from the renewables area, Vesa Laisi, CEO of Vacon, is wary of becoming dependent on the sector. “We do not want to grow just in the renewable business,” he said. “The renewable sector goes up and down according to how much governments invest in it. Generation from renewable sources is still more expensive than generation from conventional fossil fuels. Therefore, it needs somebody to subsidize the price of the electricity it produces. It is too risky for Vacon to stay focused just on products for the renewable sector, and we have not set any target for it. I hope it will keep growing alongside other industrial areas.”

Other players in the renewable industry are less skeptical about the capacity of renewable technologies to compete on the market without the support of public budgets. “There remains a perception that fossil fuels are significantly cheaper than renewable energy sources, wind power primary among them. This, however, is true only if you use a very basic calculation. In fact, if you include CO2 emission costs, wind power is already competitive with more conventional energy sources,” said Frank Nielson, CTO of LM Wind Power. “Over the past 10 years, wind turbines have become a hundred times more efficient. There has been a huge technological development and improvement in the business model. There are still subsidies for wind turbine technology, but in most countries in the world, there are subsidies for fossil fuels also; they are simply less transparent. When you take in the added geopolitical security of wind power, the fact that supplies of oil and gas are often prone to disruption, you soon realize that wind power is a feasible and very competitive alternative.”

Outside of the technology, utility companies are also playing their part to make these solutions attractive to consumers. Energi Danmark, an energy distribution company with an integrated risk management approach to the business, set up its subsidiary Energi Danmark Vind for “two reasons: to give a positive environmental profile to Energi Danmark and to provide a strong environmental case to our customers,” said Jørgen Holm Westergaard, CEO of Energi Danmark. “We have built seven wind turbines in the south of Denmark, which we have sold to our customers on the agreement that we can buy energy from these wind turbines at a fixed price for 10 years. After this time the initial cost of the wind turbines’ construction is paid back. In this way we are guaranteed a working relationship with the customer for the next 10 years, and they are guaranteed a cost-free asset after 10 years, in addition to the green profile that it will give them.”

|

| Jørgen Holm Westergaard, CEO of Energi Danmark |

These types of innovative solutions have propelled Energi Danmark from a company with 10 million Danish krone (DKK/$1.9 million) in revenues in 1999 to one with DKK 9 billion in 2011 revenues. The company’s goal for 2015 is to reach DKK 15 billion and, given a more integrated and deregulated European market, further expansion abroad.

Following Energi Danmark’s success, smaller players such as Natur Energi are attempting to carve out their own niche in providing environmentally friendly and ethical electrical energy to their customers.

In the field of solar panel technologies, there is also optimism about decreasing prices. “Grid parity will certainly happen,” stated Timo Rosenlöf, CEO of NAPS Systems, the only Finnish producer of solar panels and one of the world’s leaders in off-grid solar solutions (Figure 9). “The costs of the panels are coming down at a pace that ranges between 20% and 30% every year. Meanwhile, there is a general assumption that fossil fuels will become more and more expensive. If we compare solar power to other renewable energies, its potential for cost reduction is higher. In southern Italy, for example, solar power installations are already at grid-parity. It makes sense to install them without any sort of subsidies. The same holds in some parts of North America. It is just a matter of time for the same situation to occur further north. Here in Scandinavia this is further away due to the long winters, but the majority of southern Europe can be covered in two years. Having said that, in this scenario the question is not whether solar power can achieve grid-parity. It is more a question of how you can manage it in the entire system. Germany is a good example of this. On the 16th of July, the electricity price collapsed because of the amount of solar power produced.”

|

| 9. NAPS Systems’ solar panels installed at an airport in Morocco. Courtesy: NAPS Systems |

Reaching grid parity, or close to it, is of great importance to the renewable energy sector. As highlighted by financial chronicles in the past months, the sovereign debt crisis and the depressed value of stocks and bonds is restricting available funding. In the power industry, where developments typically require large sums of capital, this poses a serious challenge. “If financial markets are collapsing, investment decisions are delayed,” commented Heli Antila, director of Pöyry’s management consulting unit.

Ari Asikainen, Pöyry’s executive vice president for the energy business, added that “nowadays, it is even more important to concentrate on balance sheet–financed projects rather than on project financing schemes, because the latter are the ones that are generally cut first. On the other hand, balance sheet–financed projects, those of big utilities that have got their own budget, have a medium-term focus and are safer.”

|

| Ari Asikainen, Executive Vice President, Energy Business Group of Pöyry |

Pöyry is managing to cope with decreasing investment budgets in Western countries. The group’s order stock grew to €742.1 million at the end of the first half of 2011, corresponding to a 30.3% increase over the same period in 2010. Despite challenging market conditions, Pöyry’s management still expects the energy business to improve its operating profit significantly for the whole of 2011. An additional boost will come from incorporation of the engineering consulting business of Vattenfall Power Consultant, acquired last April.

The introduction of electric vehicles also risks being affected by the uncertainties regarding western economies. “Right now a lot of countries, above all Eurozone countries, are running high deficit and debt levels, and they are less willing to spend in electrification projects than some years ago,” said Paul Gustavson of Volvo. “Nonetheless, there are still a number of incentives and good programs in place. Sweden has a good one: The tax value of electric cars is reduced by 40%—as well as Holland, the UK, Germany, and Denmark. We are not asking for public money today; we want to re-balance the costs of driving by pricing more cars with higher emissions and, at the same time, by applying less taxes or giving subsidies to electric cars. This is because, whatever the technology, some sort of tax break is needed at the beginning to push volumes…. However, the biggest driver of growth for electric mobility is not public subsidies but energy security. The countries that are pushing for more electric vehicles are big industrial countries with a big car industry and without substantial reserves of oil, such as China, France, South Korea, and the U.S. Among them, the Chinese have shown the largest commitment in terms of incentives, number of cars sold, and they also have good technology.”

To some extent, companies developing energy efficiency applications might be able to avoid the downturn coming from a crisis of sovereign debts. “The energy savings sector is interesting also from a political point of view, because it does not suffer from political risk as it does not need public subsidies as renewable generation does,” said There Corporation’s Rönnlund.

Across the whole industry, China is seen both as an opportunity and a threat. The opportunities come from Beijing’s impressive ambitions in terms of making the country a green economic powerhouse. This creates space for Nordic companies to export their cleantech knowledge and products. “If you look at the new China five-year economic plan, there is no doubt that the green technology industry will be driven by Chinese money,” said Sampo Ahonen, CEO of Beneq, a supplier of coating equipment for solar panels (Figure 10). “The Chinese government is very committed to developing green solutions for its economy, and they are funding more and more projects related to that. Just to get an idea of the scale of their efforts, they are investing five times more in renewable energies than the U.S.”

|

| 10. Coating solutions for the solar industry made in Finland: the Beneq-Glaston TFC2000. Courtesy: Beneq |

On the other hand, the threats come from the awareness that Chinese industry is no longer only able to export quantity, but also quality. “The solar industry is being taken over by the Chinese, for the simple reason that they can take the technology, increase the scale, and move into production very efficiently,” said Peter Brun, Vestas senior vice president for government relations. “For wind power, even though we see more Chinese manufacturers coming in, it is not the same picture. The difference between solar and wind is the size and therefore the transportation cost of the equipment. Because these are so significant, European manufacturing still has a future.”

When it comes to industries that do not rely on such barriers, some simply suggest keeping away from the dragon. “Sweden should try to cope with China’s competition by focusing on the European market,” commented Normark from PowerCircle. “All of the technologies that have a market in China risk being quickly absorbed by Chinese producers. On the other hand, there is a lot of technology that does not have a market in China and that fits more the European and North American markets. For example, technologies regarding cable transmission have a huge market in Europe, but no market in China. I would then suggest companies to invest in hi-tech technology that fits well with Western markets. The same holds for electric vehicles; in order to cope with Chinese competition, we should focus on premium electric vehicles, on vehicles with a high added value.”

Despite these words of caution regarding one potential market, many companies from the Nordic region are actively looking to export their expertise around the world—be it to China or elsewhere. Energi Danmark, for example, has a 50% market share in its home market of Denmark and quickly growing subsidiaries in Sweden (Energi Sverige was established in 2007), Finland (Energi Suomi was established in 2009), and Norway (Energi Norge was established in 2010). Its efficiency in these markets relies primarily on a uniquely integrated IT platform, which allows it to provide its customers with a range of risk management services. However, Energi International, another subsidiary of the company, is actively involved in exporting its experience throughout the rest of the world.

“We have done projects in 29 countries, mainly in the area of loss reduction. Currently, for example, we are working in South Africa and Bangladesh,” said Westergaard of Energi Danmark. “Energi International has the right system and the technical competence to significantly reduce energy loss in the grid, but there is a tendency around the world to invest more in production rather than in loss reduction. Nonetheless, we are seeking out new projects.”

—Written and researched by Barnaby Fletcher, Jacopo Dettoni, and Caroline Stern of Global Business Reports ([email protected]) and Dr. Gail Reitenbach, managing editor, and Dr. Robert Peltier, PE, editor-in-chief, of POWER.